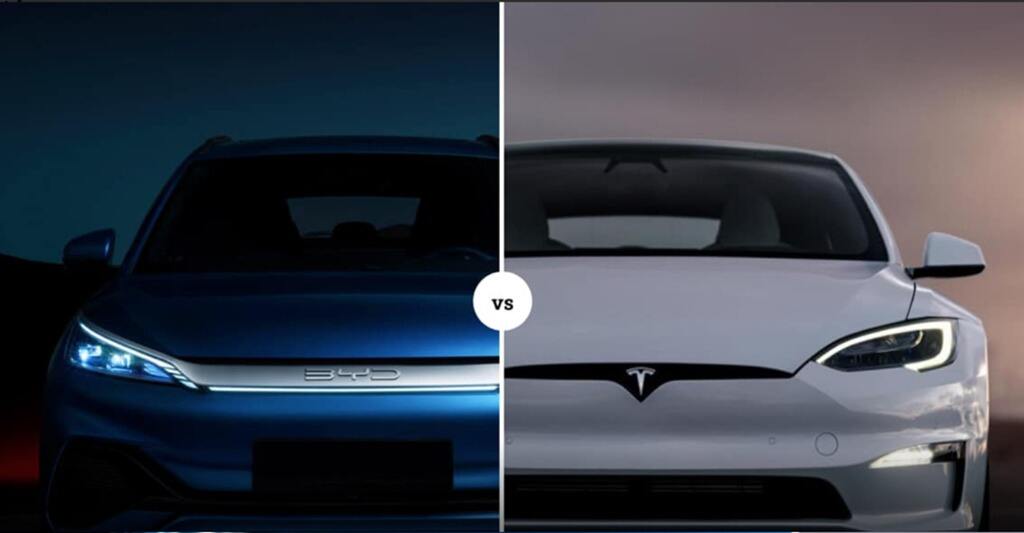

BYD Surpasses Tesla Again as Global EV Sales Leader in Q1 2025

Time: 2025-04-08

Hits: 0

Shenzhen, China – April 8, 2025 – BYD Co., Ltd. (OTC: BYDDY), a global leader in new energy vehicles (NEVs) and green technology, today announced its 416,400 pure electric vehicle (BEV) sales in Q1 2025, marking a 38.74% year-on-year growth and solidifying its position as the world’s top-selling EV manufacturer for the second consecutive quarter . This achievement outpaces Tesla’s 336,681 deliveries during the same period, which saw a 13% decline year-over-year .

Key Milestones and Market Dominance

- Global Leadership: BYD’s BEV sales accounted for 15.7% of the global market share, according to Counterpoint Research, surpassing Tesla’s 15.3% and positioning BYD as the clear leader in pure electric mobility .

- Regional Breakthroughs: In Europe, BYD achieved 551% growth in the UK, 734% in Spain, and 207% in Portugal, while Tesla’s sales in these markets dropped by 8%, 76%, and 29%, respectively .

- Product Portfolio: The company’s Dynasty and Ocean series, including the SEAL, HAN, and DOLPHIN, drove 94% of its Q1 sales, with the newly launched Denza N9 luxury sedan contributing 1,708 units in its first month of delivery .

Strategic Edge: Technology and Global Expansion

BYD’s success stems from its vertical integration model and cutting-edge innovations:

- Battery Leadership: The Blade Battery, renowned for its safety and energy density, powers 90% of BYD’s EVs, while its sodium-ion battery entered mass production in Q1, offering a 30% cost reduction and superior cold-weather performance .

- Charging Revolution: The 10C “Megawatt Flash Charging” system, unveiled in 2024, enables 400 km of range in 5 minutes—twice the speed of Tesla’s Supercharger—alleviating range anxiety for consumers .

- Global Manufacturing: BYD’s overseas factories in Indonesia, Brazil, and Hungary are set to increase annual capacity by 150,000 units in 2025, ensuring localized production and reduced tariffs in key markets .

Tesla’s Challenges and BYD’s Vision

Tesla’s Q1 decline reflects production disruptions (e.g., Model Y line conversions) and geopolitical risks, including CEO Elon Musk’s controversial political affiliations, which eroded its European market share from 17.9% to 9.3% . In contrast, BYD’s “technology-for-market” strategy—such as partnering with local European distributors and deploying blockchain-based battery recycling systems—has strengthened its compliance with EU regulations while driving cost efficiency .

Sustainability and Social Impact

BYD reaffirmed its commitment to carbon neutrality by 2045, investing €5 billion in European battery recycling facilities and achieving a 92% cobalt/lithium recovery rate . The company also launched a ¥3 billion education fund to support EV technology research and scholarships, underscoring its ESG leadership .

Future Outlook

With a 5.5 million global sales target for 2025—including 800,000 exports—BYD plans to expand its L3 autonomous driving and AI-powered cockpits across mid-tier models, challenging Tesla’s dominance in smart mobility .

“BYD’s Q1 performance proves that innovation, affordability, and sustainability are not conflicting goals but complementary drivers of growth,” said Wang Chuanfu, BYD’s Chairman and CEO. “We are accelerating the transition to an all-electric future, one that benefits consumers, the planet, and global industries alike.”